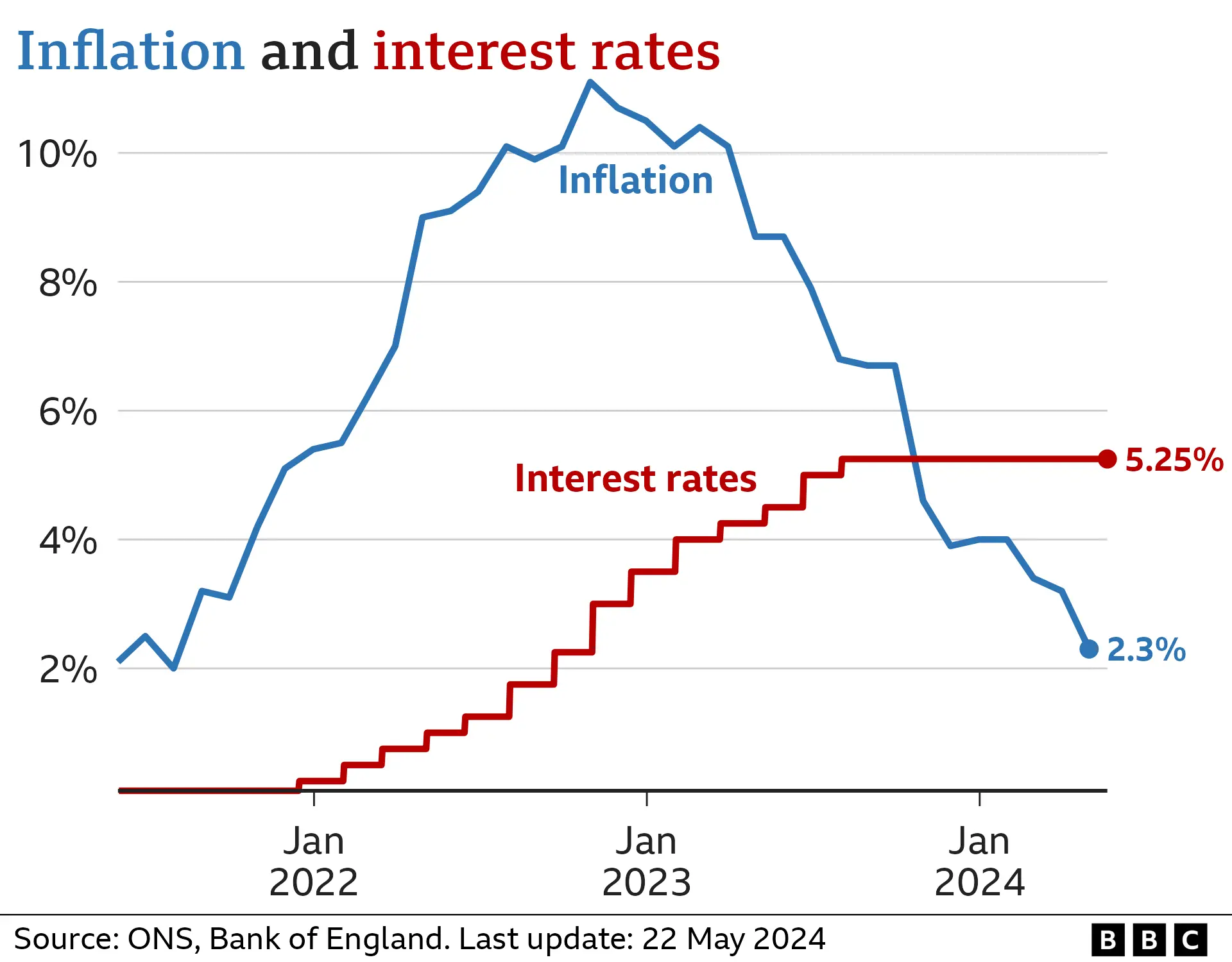

If you look at this timeline of the Fed Rates - you'll see it is a (n unfortunate) coincidencedinny_g wrote: Tue Jun 18, 2024 5:04 pmI don’t have the evidence to hand but I was tracking mortgage offers in the lead up to September 22 and I was expecting an increase of between £100 to £150. By October 22 it was £450 which hadn’t changed by Sept 23 when we re-signed. And still hasn’t changed significantly since.GG. wrote: Tue Jun 18, 2024 4:40 pmI have been meaning to bring this up - she didn't. Central Bank rates have been elevated around the world to deal with inflation fueled by a number of factors such as excess liquidity from money printing during Covid and the war in Ukraine.dinny_g wrote: Tue Jun 18, 2024 2:44 pm

Personally speaking, she cost me an extra £420 per month on my mortgage...

The Fed rate is the same as the BoE Bank Rate and the ECB is 75bps inside that on account of differences between the Euro are and UK/US economies/monetary policy. Essentially all have gone from hovering around zero to c.5%.

Truss did cause a short term crisis in the reduction in yields on central bank bonds (guilts) which in turn triggered liquidity issues with pension funds but within 12 months their liquidity exceeded the level at the point prior to the 'mini-budget'.

Truss had the correct idea of what to do with tax directionally, but in conjunction with Kwarteng committed the cardinal sin of releasing plans that were not fiscally neutral and would therefore mean more issuance of government debt (bonds therefore worth less as diluted by new issuances, yields fall - see para above).

I was pretty suprised that the tories have not challenged that the interest rate changes are a global macro driven thing, not related (save for Sunak's largesse during covid) to their policies. I think the truth is it would just go over most people's heads and the strategy seems to be that people can only process very simple messages.

It was frustrating as we planned to reduce our term by 2 years so we were budgeting a big increase anyway but now we’re paying that for the same term. So set our plans back 2 years.

Now it may just be a coincidence but I’m still blaming Truss

https://en.wikipedia.org/wiki/History_o ... ee_actions